Every minute, the world loses nearly half a million dollars to climate-related disasters. Cyberattacks now cost businesses an average of $4.5 million per breach. The risks are growing — faster than most risk strategies can evolve. In this high-stakes environment, no single player in the insurance value chain can do it alone.

That’s why the leaders at EDME believe the future of insurance isn’t in silos — it will be built through synergy. Brokers, insurers and reinsurers must come together as one connected ecosystem — sharing insights, spreading risk and enabling smarter, faster protection for clients facing the unknown.

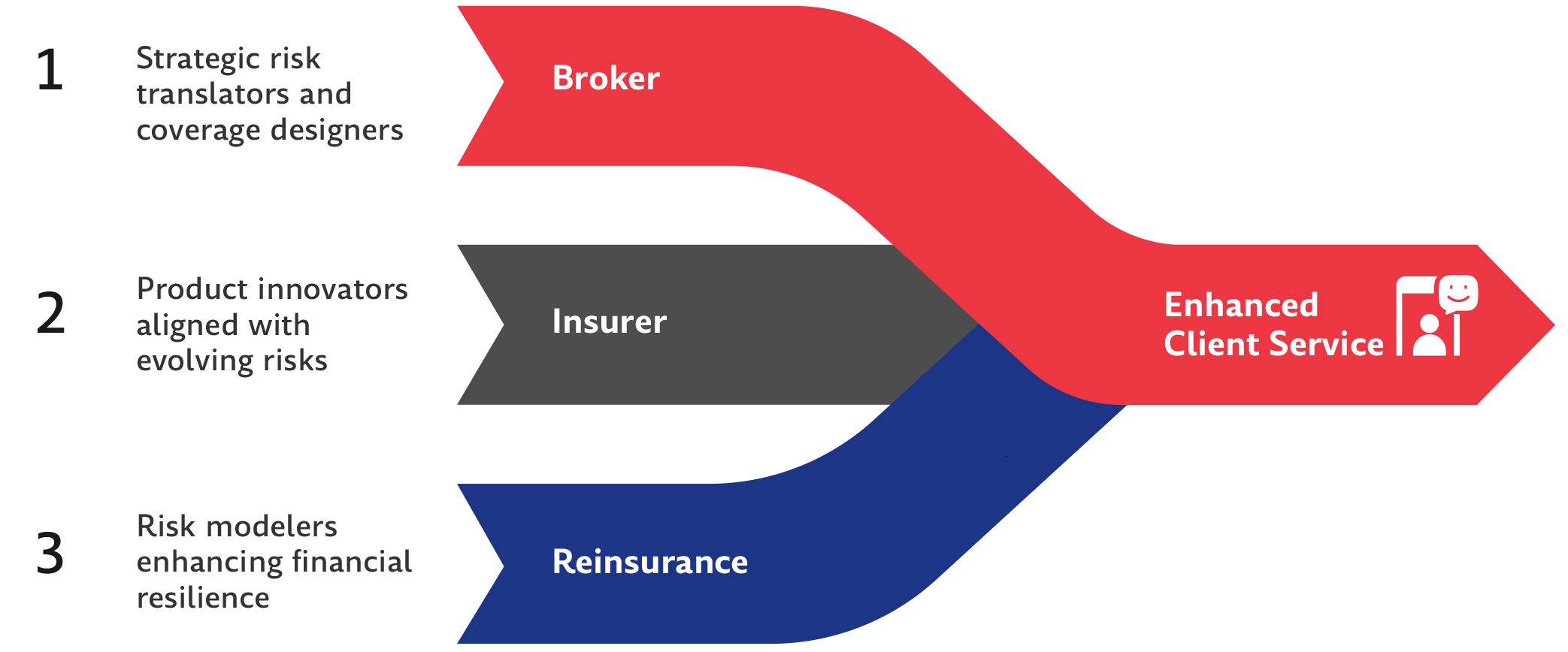

Success in the insurance industry stems from clear, complementary roles played by each stakeholder:

Brokers as Strategic Advocates: Brokers translate complex risk profiles into actionable insights. In India’s renewable sector — where local underwriters like GIC Re have deep exposure — brokers can deploy parametric covers that link payouts to objective triggers (e.g., rainfall, wind speed), closing protection gaps in climates beset by extreme weather.

Insurers Driving Innovation: Insurers leverage their underwriting expertise to design dynamic, client-centric products. Leading companies are now embedding services such as travel or cyber security directly into their offerings. In India, regulatory support through IRDAI’s reforms is fueling product innovation that meets both modern risks and traditional market needs.

Reinsurers Bolstering Resilience: With their cutting-edge risk modeling, reinsurers provide the financial strength necessary for sustainable coverage. Their work in climate modeling and real-time risk monitoring is key to refining coverage terms, reducing exposure and bolstering market confidence.

Let us explore how these stakeholders can co-create innovative solutions, leverage collective strengths to address emerging risks and enhance brokers’ negotiation power to deliver superior client outcomes.

By uniting collective strengths, these stakeholders craft solutions that directly address modern challenges:

Climate Change: With global insured losses surging, parametric insurance that links payouts to measured triggers (like wind speeds or rainfall) is gaining traction. Such models, successfully deployed in regions like Southeast Asia, are equally relevant in India, where localized data and environmental trends demand tailored solutions.

Cyber Risks: As cybersecurity threats multiply, insurers are incorporating proactive threat detection into policies. These enhancements not only mitigate potential damage but also set the stage for broader market penetration — vital in India’s digitally evolving economy.

Political and Regulatory Risks: Specialized insurance addressing geopolitical and political uncertainties is on the rise. Brokers play an essential role here, tailoring coverage around complex scenarios, with regulatory frameworks acting as both a guide and a challenge in cross-border solutions.

As the insurance paradigm shifts from transactional exchanges to proactive collaborative networks, the integrated model of brokers, insurers and reinsurers will define the future. Regulatory bodies and technological advancements provide both challenges and opportunities that, if navigated wisely, can empower the ecosystem. EDME’s thought leaders assert that brokers who master ecosystem orchestration will lead the evolution of client-centric insurance. Now is the time to embrace this transformative approach and drive the industry into a resilient, innovative future.

Registered Office: 2nd Floor, Privillion, East Wing, Sarkhej - Gandhinagar Highway, Vikram Nagar, Bodakdev, Ahmedabad, Gujarat 380054. IRDAI License Number: 146 | Composite Broker | License Valid till: 9th April, 2027 | CIN: U99999GJ2001PLC062239 Corporate Office: VIOS Tower, 6th floor, Off Eastern Express Highway, Sewri - Chembur Rd, Mumbai – 400037 Telephone: 1800 120 2510 | Website: www.edmeinsurance.com In case of any queries/complaints/grievances, please write to us at clientfeedback@edmeinsurance.com.